Art projects are a great way to stimulate the economy. I recently wrote why the money for the NEA, taken out from the senate stimulus bill, should be re-included (which eventually was added back in conference). Darren W. Miller of Madness of Art has a much better post on this than I do. He says:

Spending stimulus dollars on the arts will, unquestionably, create jobs, but it also does a lot more than that: reinvigorating arts education in ours schools; rebuilding communities through public art (literally and figuratively) and thereby increasing local property values, improving the real estate market and making a place more attractive to small businesses; engaging new and otherwise financially shut-out audiences through free musical and theatrical performances; revitalizing and modernizing our public library system; and, in general, renewing the role of the arts in our culture, recognizing how it can boost our economy, placing value again in its transcendent powers.

All of these things are important, but it also good to note the progressive nature of funding the arts economically. First I’ll just describe simple economic theory and the ideas behind progressive taxation and public funding. In Microeconomics, supply and demand is “an economic model based on price, utility and quantity in a market.”

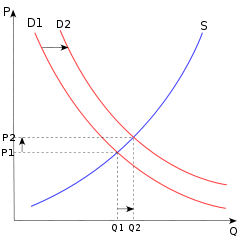

In a supply and demand model there are curves for both supply and demand along an x-axis labeled “quantity” and y-axis “price”:

As the demand for a good increases the demand curve shifts from D1 to D2 increasing the optimal combination of the good’s price and the amount of the good that is produced.

For Luxury items the supply curve is far more steeply sloped, so that when demand goes up, new goods aren’t produced, but rather the price just increases. This is one of the main arguments against Supply-Side economics, because tax cuts at the top of the income spectrum is essentially a tax cut on luxury goods. Consequentially, wealth doesn’t actually trickle down, it just gets pocketed by the already wealthy business owners (who give a paltry portion of their income back to society compared to the poorest of us).

On the other hand, goods that are necessities are relatively inelastic, things like food or some kinds of clothing. These things are produced in such a huge quantity that increases in demand don’t affect the price so much. This means that the slope of the supply curve is low, possibly near zero. When goods like this are bought, much of the price of the good is in labor costs. This rewards the greater production of goods and real labor.

What does this have to do with art? If we award a grant to an artist or fund their project another way, there will be essentially no overhead costs. Most of the money goes to the production of the work, and in the case of music is used to hire other musicians. Artists, being on the lower end of the income scale, tend to buy less luxury goods and more goods of necessity. This, in turn, encourages greater good production (and a higher GDP) as opposed to inflating luxury prices.